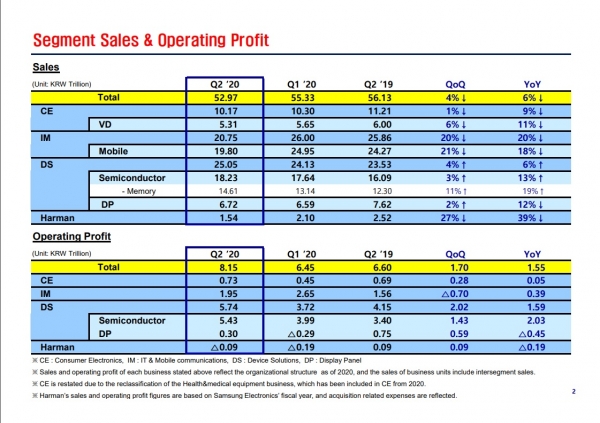

Samsung Electronics marked 8.15 trillion won in operating profits and 52.97 trillion won in sales in the second quarter of 2020, the company said on Thursday.

It is a rise of 23.5% and drop of 5.6%, respectively, year over year.

Samsung’s semiconductor business contributed the lion’s share in operating profits with 5.43 trillion won. Firm demand for memory from data centres and PCs due to the impact of the COVID-19 pandemic helped the performance.

Uncertainties remained for second half of 2020 due to the pandemic, but the South Korean tech giant expects demand from mobile and graphics application to recover going forward thanks to new smartphone and game console launches.

Samsung’s mobile business, despite store closures around the world due to the virus outbreak, contributed the second most profits nonetheless with 1.95 trillion won. Sales were hurt from the virus outbreak but the company managed cost to maintain profitability, it said.

The South Korean tech behemoth predicts fierce competition in the market going forward amid uncertainties from the outbreak. Samsung will launch new flagship models the Galaxy Note and Fold and expand low- to mid-tier model sales while continuing its efforts to improve profitability, it said.

Samsung’s display panel business also contributed 300 billion won in operating profits despite demand falling thanks to a one-time payment. The payment likely refers to Apple’s penalty for not buying enough OLED panels.

The South Korean tech giant’s consumer electronics business contributed 730 billion won. Sales were hurt from the COVID-19 pandemic but efficient management of the global supply chain to meet short-term demand for TVs helped profits, the company said.

Memory demand to remain strong in 2nd half

In the conference call for the quarter, Han Ji-man, senior vice president of the memory business, said demand from mobile is expected to rise from new smartphone launches while those from server will remain strong. Graphic DRAM will see high demand from new gaming console launches while NAND flash will be in demand from low- to mid-tier products that is growing despite the uncertainties from the pandemic and global trade wars.

Server solid-state drives (SSD) will show strong demand from the trend for high capacity and high resolution streaming that is in demand due to social distancing measures, Han said. However, customers were holding onto more stocks which was a potential contingency.

Han was careful to comment on the trajectory of DRAM prices, which hit bottom in 2018 but is now recovering. “There will be many factors that effect price in the second half of the year so it is hard to tell at the current time,” he said.

Samsung will accelerate transition to 6th generation V-NAND and supply prototypes of DRAM made using the extreme ultraviolet (EUV) process in the second half of the year, Han said.

Meanwhile, the company’s foundry business marked its highest quarterly sales in the second quarter. Samsung said clients wanted to secure stocks due to the uncertainties caused by the COVID-19 pandemic which helped sales. The company has begun production of 5-nanometer chips and is developing 4-nanometer process.

Smartphone sales to expand in Q3

Lee Jong-min, vice president of the mobile business, said the company expects smartphones sales to expand in the third quarter compared to the second quarter. Profits will also improve from launches of flagship models such as the Galaxy Note and Galaxy Z Fold. However, uncertainties caused by the COVID-19 pandemic remained, Lee said.

Samsung’s mobile business, called IT & Mobile Communication by the company, posted 20.75 trillion won in sales in the second quarter, its lowest since 2013.

Lockdown measures is North America and Europe caused smartphone unit sales and revenue to decline compared to the first quarter. It sold 57 million handsets, with 54 million of them being smartphones.

Lee stressed that 5G and foldable smartphone will be a catalyst for device changes and help the business recover. Demand from the market showed signs of recovery in June.

Samsung Display expects recovery in Q4

Samsung Display, Samsung Electronics’ display unit, expected profits to recover in the fourth quarter.

Demand for displays will begin its recovery in the third quarter from low- to mid-tier smartphones, Samsung Display vice president Choi Kwon-young said, but demand from OLED display smartphones will be slower.

It will take some time for earnings to recover due to this, Choi said. Samsung Display secures over 80% of its sales from mobile OLED panels.

COVID-19 also remained an uncertainty, the vice president said. The company also had no new plans to invest in foldable displays at the time. It was preparing various form factors using ultrathin glass and it will collaborate with clients to showoff new products, he said.

Samsung Display was also reducing its Liquid Crystal Display (LCD) line but will make sure it delivers panels to clients up to the end of the year. It will accelerate development Quantum Dot display, Choi said.

The business posted 300 billion won in operating profits and 6.72 trillion won in sales, a decline of 60% and 12%, respectively, from a year prior. The company spent 800 billion won in facilities investment.