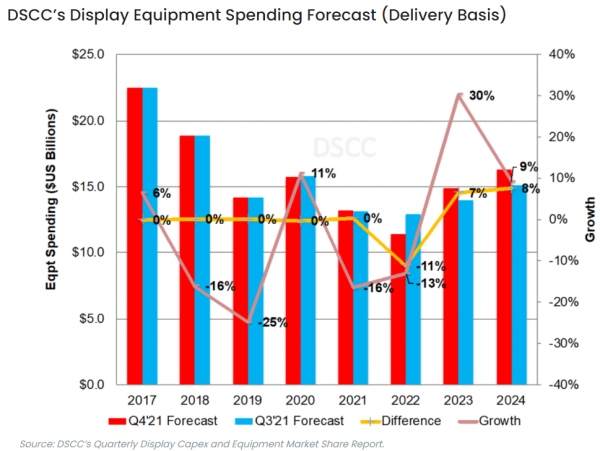

Turnaround to happen 2023 at the earliest

South Korean display equipment makers are expected to face a difficult year in terms of earnings in 2022 due to conservative spending expected from global display panel makers.

As of November, orders for OLED panel production equipment were lower than it was over the same time period in 2020.

Last year, for Gen 6 (1500x1850mm) OLED lines, Chinese companies BOE, CSOT and Tianma each invested to expand their production capacities.

BOE was investing money to start the first and second stages of its B12 factory at Chongqing for a capacity of 32,000 substrates per month. COST was spending funds to add 30,000 substrates per month in production capacity from the addition of its second and third stages at the T4 factory at Wuhan. Tianma invested in the first stages of TM18 at Xiamen to add 16,000 substrates per year in capacity. In total, Chinese companies added 78,000 substrates per year in their OLED production capacity in 2020. Samsung Display and LG Display didn’t spend on their OLED lines last year.

However, this year, BOE is adding only 16,000 substrates per month from the third stage of B12; Everdisplay is adding 7,500 substrates per month at its Shanghai Fab 2. LG Display recently restarted its spending on its OLED lines. The company is planning to add 15,000 substrates per month in capacity each at E6-3 and E6-4. Samsung Display is spending on its A4E line that will add 15,000 substrates per month in production capacity. The total for this year comes down to 68,500 per month in OLED panel production capacity.

Everdisplay may place orders for another addition of 7,500 substrates per month in production capacity at its Shanghai Fab 2 next month, which will bring the total of 2021 to 76,000 substrates per month.

In terms of pure capacity, the expansion may seem level between 2020 and 2021. However, LG Display’s E6-3 line already had deposition and encapsulation equipment placed in it. Samsung Display’s A4E is not a new line the company is only planning to spend to convert the thin-film transistor process.

These developments mean the earnings of South Korean display equipment makers won’t improve even up to the next year.

BOE and CSOT may announce new investment plans but unless they execute this during the first half of 2022, equipment suppliers will only see earnings improve in 2023.

The time difference between order and payment could be short as four months but as long as a year.

Samsung Display is also not likely to spend additionally on expanding quantum dot-OLED production. LG Display is also unlikely to invest in expanding its Gen 10.5 large-sized OLED production capacity in 2022.

South Korean display kit makers may get some orders for equipment used in display panel modules or some adjustment to existing lines by display panel makers.

Meanwhile, analyst firm Display Supply Chain Consultants expect spending on display equipment to hit its lowest point next year and recover starting in 2023.