Chinese display panel makers are expected to shift some of their liquid crystal display (LCD) TV lines for those of monitors, according to market research firm TrendForce.

This was due to their 10.5-generation TV LCD lines increasing in operations __ the previous 8.5 and 8.6-generation TV LCD lines will be shifted to monitor LCD lines.

TV panel supply was insufficient during the second half of 2020 due to the COVID-19 pandemic and Samsung Display halting LCD panel production but Chinese companies will maintain their plan to shift some of their TV panel lines for those for IT, the research firm said.

CSOT and HKC will secure market shares previously controlled by Samsung Display, TrendForce said. BOE was the leader in IT panels with CSOT and HKC following it.

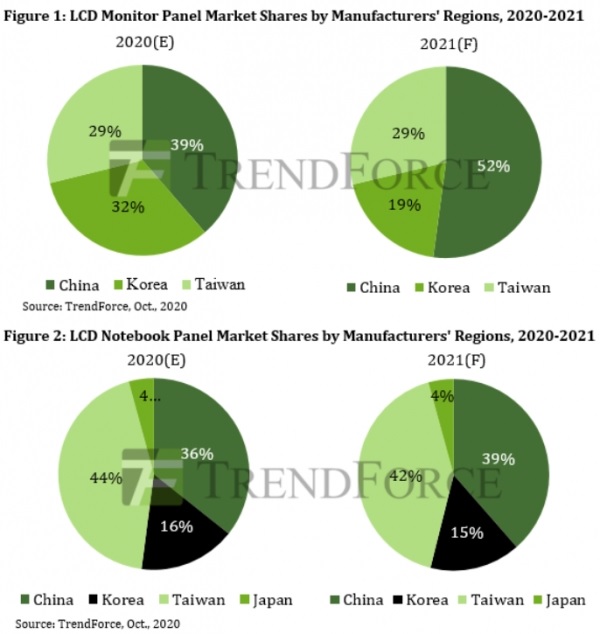

Chinese companies’ market share in monitor panels will be 39% this year but this will increase to 52% in 2021.

CSOT will increase its monitor panel production capacity with the acquisition of Samsung Display’s 8.5-generation factory in Suzhou. CSOT has competence in VA panels but was weak in IPS, TrendForce noted.

HKC has three 8.6-generation fabs in Chongqing, Chuzhou, and Mianyang. The company has both IPS and VA technologies but lacks experience in producing curved VA panels, the research firm said.

In notebook panels, Chinese companies’ market share will be 36% in 2020 but this will increase to 39% in 2021.

COST is aiming to expand in the premium and mid-tier LTPS notebook panel market. It will need to compete with Samsung Display’s OLED panels in this segment. CSOT is expanding notebook panel shipment to offset the fall in orders for smartphone panels from Huawei due to US sanctions.

HKC will focus on mid- to low-tier notebook market. TrendForce believes it will take time for the company to gain a meaningful market share in the market.