Outsourced semiconductor assembly and test (OSAT) market grew in the third quarter, continuing its growth trajectory of the first half of 2020, data from market research firm TrendForce shows.

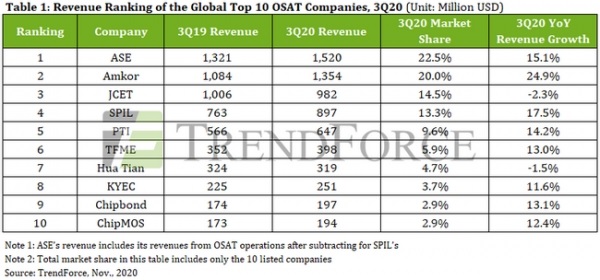

The top OSAT companies in the world marked US$6.799 billion in sales in the third quarter, an increase of 12.9% from the same time period a year ago.

It was also an increase of 7% from the previous quarter.

Huawei’s inventory buildup for semiconductors likely helped this growth.

Demand for 5G and Wi-Fi that started in the first half continued to the third quarter.

Taiwan’s ASE top the list with US$1.52 billion in sales in the third quarter, a growth of 15.1% from a year ago.

Amkor took second place with US$1.354 billion, a jump of 24.9% from a year prior.

Out of China’s three top OSAT firms, JCET, TFME and Hua Tian, only TFME posted growth.

TFME posted US$398 million in sales in the third quarter, an increase of 13%. Customer AMD’s increased demand for backend packaging for its CPU and GPU likely helped this growth, TrendForce said.

Meanwhile, JCET and Hua Tian saw sales decline 2.3% and 1.5%, respectively, due to China’s low PPI, the research firm said.

Huawei’s OSAT partners SPIL and KYEC benefited the most from the Chinese tech giant’s buildup. Each saw sales of US$897 million and US$251 million, an increase of 17.5% and 11.6%, respectively, year-on-year.

Companies Chipbond and ChipMOS benefited from demand for DDI from large panels and iPhone’s OLED. Each posted US$197 million and US$194 million in sales in the quarter.

TrendForce said it expects OSAT companies’ sales to continue their growth in the fourth quarter. This will be thanks to continued demand from 5G and Wi-Fi 6 as well as demand for car panels and large-sized panels.