South Korean equipment makers recorded mixed results in the first quarter of 2021.

Fab equipment vendors posted high growth, while display equipment firms underperformed.

Fab equipment makers benefited from aggressive spending by semiconductor companies.

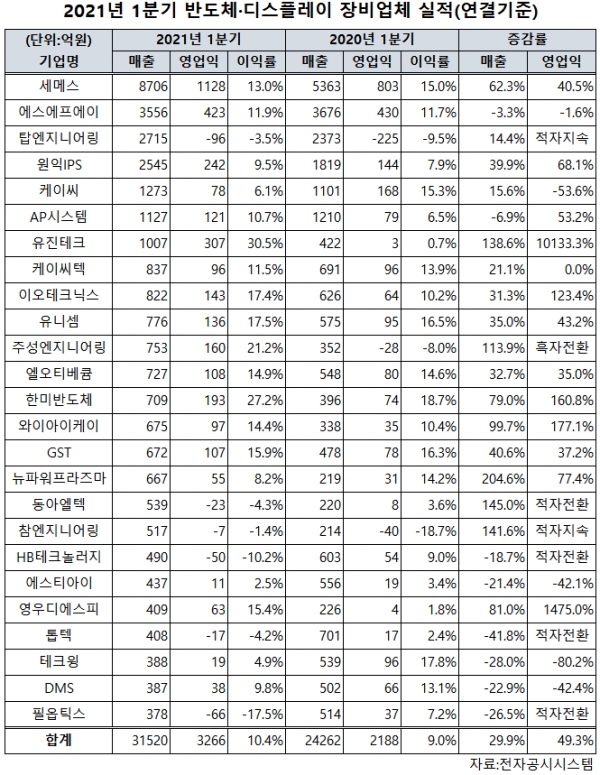

Semes, Samsung Electronics’ fab equipment subsidiary, recorded 870.6 billion won in sales, an increase of 62.3% from a year prior.

It recorded 112.8 billion won in operating income, an increase of 40.5% over the same time period.

The growth likely stems from Samsung starting to put in equipment to its P2 chip line at its Pyeontaek plant during the quarter.

Overheat transport accounted for 60% of the sales recorded by Semes during the quarter.

SFA recorded 355.6 billion won in sales and 42.3 billion won in operating income, a drop of 3.3% and 1.6%, respectively, a year prior.

Non-display business accounted for 65.1% of its sales. SFA, which previously focused on display kits, managed to record level earnings to a year prior thanks to other business areas.

Wonik IPS recorded 254.5 billion won in revenue and 24.2 billion won in operating income, a surge of 39.9% and 68.1%, respectively, from a year prior.

The firm previously focused on fab equipment for use in memory chip production. But it has begun supplying kits for foundry beginning last year, which helped growth.

Eugene Technology recorded 100.7 billion won in revenue and 30.7 billion won in operating income.

The company recorded an operating margin rate of 30.5%. Its LPCVD equipment supplied to SK Hynix for the latter’s M16 DRAM fab led the growth.

Jusung Engineering posted 75.3 billion won in sales in the quarter, double that of the year prior. It turned a profit from a year prior and posted 16 billion won in operating income.

The company won the order for atomic layer deposition kits from SK Hynix for use in next-generation DRAMs. Jusung is the sole supplier of the kits.

Hanmi Semiconductor recorded 70.9 billion won in sales, a jump of 79% from a year prior. Its operating income increased 160% year-on-year to 19.3 billion won. It won 22 orders during the quarter. It has signed supply deals with SK Hynix, Amkor Technology Korea, ASE, NXP, Nanya, SPIL and others for a combined worth of 87 billion won.

YIK recorded 67.5 billion won in sales and 9.7 billion won in operating income, a jump of 99.7% and 177.1%, respectively, from a year prior. The firm mainly provides electrical die sorting equipment. The firm is seeing more orders from Samsung, having signed a 155.3 billion won deal with the tech giant in the first quarter alone.

South Korean fab equipment makers are expected to post solid growth throughout 2021 from increased spending this year by Samsung and SK Hynix.

SK Hynix had said in the conference call for the first quarter that it plans to execute some of its spending it planned for 2022 earlier to this year.

SEMI is expecting global fab equipment spending to increase 15.5% this year to US$70 billion.

Meanwhile, South Korean display equipment makers underperformed during the first quarter.

Samsung Display and LG Display have been conservative with their spending due to uncertainties surrounding the display market.

But increased spending in OLED from Chinese panel makers such as BOE and Tianma staved off a huge dip in profitability.

Only few companies recorded growth, such as AP Systems, which saw sales drop 6.9% year-on-year but operating income surge 53.2% over the same time period.

The company benefited from laser annealing equipment supplied to BOE for the B12 line.

Youngwoo DSP saw a surge in its operating income from supplies to its Chinese customers.

KC Tech saw sales jump 21.1% but operating income remained flat. Top Engineering saw 9.6 billion won in operating loss from the 6.1 billion won operating loss posted by subsidiary Powerlogics. Dong A Eltek recorded 2.3 billion won in operating loss, though sales doubled. The firm said increased cost from the pandemic stunted growth.

Charm Engineering continued to record loss. HB Technology, Toptec and Philoptics all turned to the red.

Local display equipment makers are expected to see a turnaround starting in the fourth quarter when Samsung Display and LG Display decide on new spending plans around the same time.