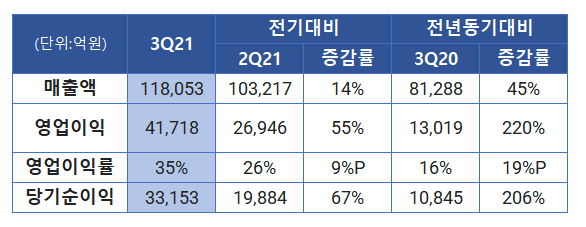

SK Hynix said on Tuesday that it recorded 11.8 trillion won in sales and 4.17 trillion won in operating profit during the third quarter this year.

It is an increase of 45% and 220%, respectively, from the third quarter of 2020.

The sales figure is SK Hynix’s best quarterly performance to date.

The last time the company recorded operating profit higher than 4 trillion won was back during the fourth quarter of 2018.

SK Hynix’s operating margin during the third quarter this year was 35%, 19 points higher than a year ago.

The company credited increased prices of its memory chips and high demand for the growth.

SK Hynix said it also expected high demand for memory chips to continue going forward.

It said it improved yield rates of 10-nanometer (nm) Gen 3 DRAM and 128-layer NAND flashes, which improved its cost competitiveness that also helped the growth.

The company shipped less than DRAM than expected but this was offset by the increase in average sales prices, the South Korean chipmaker said.

Demand for NAND flash was high in the server and mobile spaces that helped shipment exceed expectations, it added.

South Korean analysts expect DRAM prices to fall starting in the fourth quarter but SK Hynix said it expected solid demand through the remainder of the year.

It said demand will be maintained thanks to the launch of Windows 11 in October that is increasing PC sales.

NAND flash shipment is expected to grow by double-digit from the third quarter to the fourth, SK Hynix said.

Meanwhile, during the conference call for the third quarter, company executives said it expected its acquisition of Intel’s NAND business unit to be completed within the year as planned.

The deal only needs the approval of regulators in China to go through.