Samsung won’t spend fewer wafers or halt production lines in its chip production despite the recent downturn of the global memory chip market, the company said on Tuesday.

The company’s chip business reported an operating income of 270 billion won for the fourth quarter of 2022, its lowest in ten years.

Rival memory chipmakers Micron and SK Hynix had said they plan to spend less on facilities this year as well as produce fewer chips.

SK Hynix had said in its third-quarter earnings call that it plans to reduce its spending on facilities in 2023 to 50% of that of 2022.

Micron in the meantime said it plans to make 20% fewer chips this year.

However, Samsung said in its conference call for the fourth quarter that while the current weak market condition is unfavorable to its earnings, it is also a “good opportunity” for the future.

The tech giant will continue its spending on infrastructure in preparation for the mid- to long-term demand, the company said. Its CAPEX in 2023 will be at similar levels to that of 2022, Samsung added.

The company said there could be an impact on bit growth from maintenance or equipment reorganization.

These are done to optimize operation and shift chip product processes by all chipmakers and can impact chip output.

Samsung’s statement means that there can be a naturally occurring reduction in its chip output from these instances but it won’t reduce its output forcefully.

The company likely has confidence in its cost competence over rivals.

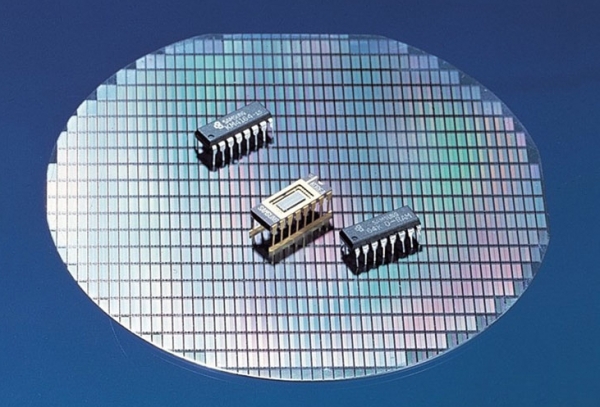

Samsung is the world’s largest memory chipmaker and has always outproduced and outspent its rivals.