The global CMOS image sensor market contracted for the first time in seven years last year due to low demand for electronics and IT devices, according to Japanese analyst firm Techno Systems Research (TSR).

Sony, the undisputed leader in the sector, saw its market share increase during this drop while its South Korean rival Samsung saw its revenue nosedive.

Last year, the market contracted by 5.7% and was worth US$18.6111 billion, TSR said.

However, the market is expected to grow 8.7% this year to be worth US$20.244 billion, the analyst firm also said, thanks to the market hitting bottom last year and consumer demand recovering.

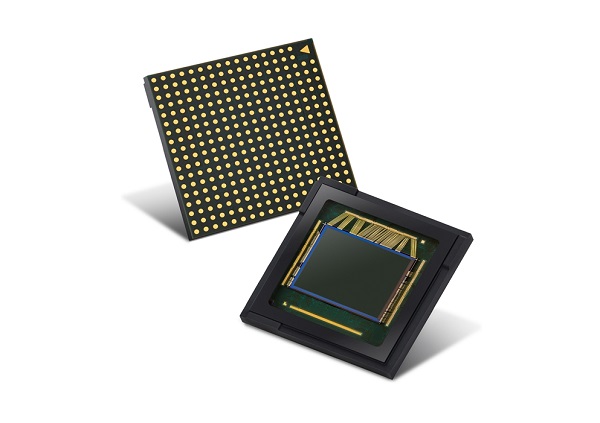

CMOS image sensors, or CIS, are logic chips that turn light into digital signals and powers small cameras used in smartphones, cars and robots.

Sony saw its revenue increase 8.1% year-on-year last year to US$9.2555 billion.

The Japanese tech giant is a supplier of its sensors to Apple for iPhones and sells mostly high-end products.

Onsemi, which mostly supplies CIS for automobiles, saw its revenue jump 36.5% to US$1.215 billion last year from 2021.

In contrast, Samsung and SK Hynix saw their revenue dip. Samsung recorded US$2.912 billion in revenue last year, a drop of 25.8% from 2021.

The company relies on smartphones for its CIS sales and there was a huge drop in demand for consumer electronics last year.

SK Hynix recorded an even steeper drop of 34.4% year-on-year to US$480 million as it mostly supplies low- to mid-end phones.

What is also noticeable is its drop in unit sales; from 2021 to 2022, it dropped from 575 million to 311 million. This is highly unusual and likely means there was an issue with its customer. SK Hynix sells its CIS mostly to Samsung.