In 2020, the domestic PCB market is expected to shrink by 1.5%, indicating that less smartphone boards would be sold than semiconductor boards.

The Korea Printed Circuit Association (KPCA) said on Jan. 14 that local PCB market would fall 1.5% to KRW 9.75 trillion. In terms of production, the total volume is to reach 32.65 million square meters to reflect a 2.2% decline.

Broken down, sales of the rigid PCB market is to fall 2.5% to KRW 3.9 trillion, while those for flexible PCBs are to slide 3.8% to KRW 3 trillion.

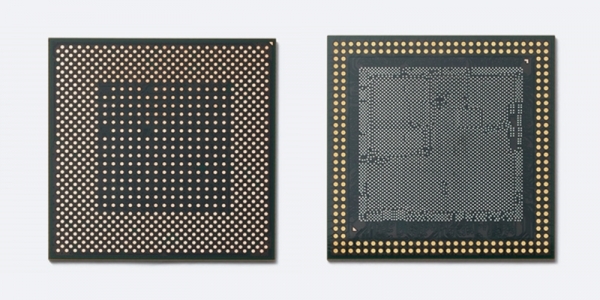

Sales in the semiconductor board market, however, was projected to rise 2.5% to KRW 2.85 trillion. In total, the PCB market will be worth around KRW 9.7 trillion.

RPCB and FPCB is likely to be affected by the conditions of the overall smartphone market.

Most local PCB firms sell more of smartphone boards. Samsung Electronics and LG Electronics are both prepared to double the volume of ODM smartphone volume they produce this year, a move that would further impact PCB makers. For one, more of the PCB orders may go to Chinese suppliers, according to industry sources.

“Chinese PCB firms have become much more sophisticated, with some showcasing proficient business strategies,” said KPCA.

The market for flexible PCBs is expected to become more polarized, with RFPCB likely to see bigger sales due to the launch of 5G smartphones, foldable phones and multi-camera smartphones.

The semiconductor board market, on the other hand, is projected to continue its growth this year, with companies like Samsung Electro-Mechanics, Daeduck Electronics and Simmtech at the lead.

“Semiconductor board sales are expected to stay strong and buffer the fall of the board market in general, but investment in PCB is still likely to shrink,” said KPCA.

In 2019, the local PCB market rose 1% on-year to KRW 9.9 trillion. In terms of production volume, it fell 1.5% to 33.4 million square meters.

The Elec is South Korea’s No.1 tech news platform.