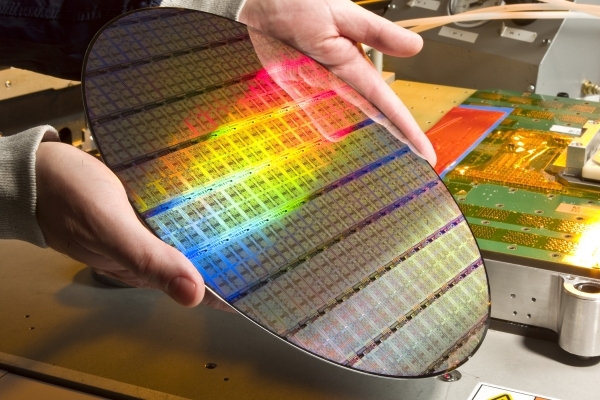

The supply shortage for Silicon wafer, a raw material for semiconductors, has been eased. This is thanks to the active expansion of the industry since 2017.

The Japan Sankyo Times reported on the 18th that the wafer market was once thought to be in short supply due to the International Semiconductor Equipment Materials Association (SEMI) data. Masayuki Hashimoto, chairman of the company, said, "The investment capacity of each company was fast, and the overheating phenomenon that was due to the shortage of wafers is disappearing." “The supply capacity of 300mm wafer increased by 700,000 per month this year,” he added. Sumco is a leader that dominates ⅔ of the global silicon wafer market with ShinEtsu Chemical.

The wafer industry has invested in full-scale production as supply shortages continue. GlobalWafers has added a production capacity of 120,000 wafers (300mm) per month to its second factory in Cheonan, Chungnam in November. Siltronic, a subsidiary of Barker, a German chemical company, raised its facility investment to EUR 280 million (about KRW 360 billion), an increase of EUR 20 million (about KRW 25 billion) in 2018.

The Sankyo Times analyzed the severity of the shortage as a reflection of the investment last year. The production adjustment by NAND flash production, one of the major demand sources, has affected the demand reduction as well. According to SEMI, the wafer shipment area in July-September 2018 was 3,255 million square inches, a 3% QoQ increase. It is the highest ever record. This is a 30% increase in comparison to 2015.

It is the analysis of the Japanese wafer industry that supply has increased but it is not 'excess'. In 2019, 6.5 million units will be supplied to the entire industry. It is expected that the expansion of the capacity will continue.