Solving the high cost and low efficiency is an issue

Between the large organic light emitting diode (OLED) based on quantum dot (QD) color filter (CF) that is being prepared by Samsung Display and LG Display's white OLED (WOLED) panel, which has a superior competitive advantage?

The analysts say Samsung will take the lead if it achieves the yield of over 70%. In contrast, LG’s product cost competitiveness is estimated to be high. In the large OLED market, it is implied that Samsung should achieve the 70% yield within a short time to compete with LG Display.

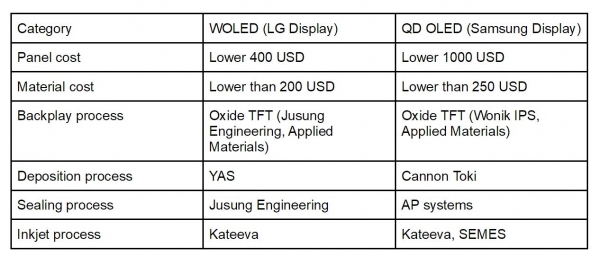

According to IHS Market data on January 18, the initial cost of the QD OLED panel was estimated to be 1,000 dollars (about KRW 1,130,000) based on the price of a 55-inch 4K resolution screen. Cost of WOLED panel of the same specification is at the lower end of 400 dollars (about 450 thousand won). The price difference is double. The yield standard is assumed to be 30% for Samsung and 70% for LG. The yield of LG Display is currently estimated to be over 70%.

Assuming that the yield of both companies is the same at 70%, QD OLED is expected to be lower than WOLED by 70 dollars (about 80,000 won). This is because the material cost itself is low.

To implement the WOLED technology, LG puts the yellow, blue, and red light emitting materials on the substrate (to make white) and mixes the three colors. White forms the three primary colors of RGB light through CF. QD OLED uses only blue. It emits light (PL: Photo Luminescence) when it touches light, and by applying the characteristics of QD that emits different colors according to the wavelength to the OLED CF, it produces a RG color.

An industry expert said, "QD OLEDs that use fluorescence rather than phosphorescence-based WOLEDs can have a cost structure that is more advantageous, even in the same three-layer stacked light emitting structure." He said, "QD OLED is expected to use inkjet printing technology to save material to make CF."

Phosphorescent materials are four times more efficient at converting energy to light than fluorescent materials. But they are expensive. The blue color used for QD OLED exists only as a fluorescent. At the yield of 30%, QD OLED material costs were estimated to be around $200 (about 220,000 won) and, at the yields from 70%, to be about $150 (about 160,000 won). WOLED material cost of 70% yield is less than 250 dollars (about 280,000 won).

LG Display took five years to turn a profit after beginning mass production of WOLED in 2013. Samsung Display is expected to focus its efforts on overcoming the low yield of QD OLED. "QD OLED will emphasize that 8K is a basic and unique technology from OLED," said Jaehyuk Lee, Korea branch manager for Display Supply Chain Consultant (DSCC).

Samsung Display is currently preparing to operate the QD OLED pilot line at L8-1, the 8th generation LCD display production line in Tangjeong, Asan city, Chungcheongnam-do. Development, mass production verification and investment direction will be decided by next April. Jae-yong Lee, Vice Chairman of Samsung Electronics, is also reported to be interested in the issue as he has visited Samsung Display business sites several times this year.